Real Time Frac Analysis

What You are Missing and What to Expect

Lyle V. Lehman > February 1, 2022

Very few operators require real time monitoring and analysis of their frac completions, and I am guessing that the reason is a lack of appreciation for the benefits of evaluating each stage as the treatment moves forward. This has become less popular as the cost-side of the unconventional development replaces engineering due diligence. Back in 2000-2006, every major service company offered this service and yet today the offering has been eliminated from their price books. Still, our experience is that there are more situations than one can imagine where real-time analysis pays off.

Here are the steps I have found to help realize benefits:

1. Measure the near wellbore environment (number of perfs open and tortuosity). Specifically, are the perfs breaking down with acid or more so with low-concentration proppant volumes? What can be changed to improve this condition?

2. Understand the reservoir permeability and the need to change the proppant schedule or fluid to improve proppant distribution.

3. Measure the stresses to determine if they are increasing to a critical level which can impact the fracture geometry — including generation of a horizontal fracture.

- Determine if the perforating scheme needs to be revised.

- Does an interval need to be skipped?

4. Assess the progress of the gel or high viscosity friction reducer to determine if it is working or impeding the proppant transport.

5. What is the reservoir quality and what about the quality can be used for the next well's completion design?

Figure below shows plot of a Barnett 'slick water' treatment match/analysis which required a real time change in friction reducer concentration as perfs are bridging with changes in concentration at 28 - 60 minutes, remedied at 112 minutes.

As seen in the graphic above, the friction reducer concentration was increased during the treatment to improve viscosity. The treatment also generated a non-linear net pressure increase which is an indication of generating stimulated reservoir volume (SRV).

A bit of background: Back in 1999, I was summoned to move to Houston and represent a cross-disciple team inside Halliburton that was focused on real-time operations. Despite being 23 years ago, the idea was a bit old in that there was a highly recognized book "Real-Time: Preparing for the Age of the Never Satisfied Customer" by Regis McKenna printed initially in 1997. The idea behind the book was that by understanding the goals of the customer and then matching the ever-changing data that supported the final sale, the product or service provider was offering a solution/product that would be accepted and purchased. In the world of why people do not buy from product/service providers, this eliminated 'No Need, No Hurry, No Worry and No Trust' hurdles. A famous quote: "An Empowered customer becomes a loyal customer by virtue of being offered products and services finely calibrated to his or her needs."

Move that thought forward to today and attempt to fit the principal into the world of unconventional well completions and what do you have? For the most part, Real Time has joined Elvis and left the building. Partly because the ugly truth that the cost side of the unconventional equation is the easier path toward profit over asset improvement. Add to this the fear of knowing the quality of your asset (yes, sometimes knowledge brings regret) and the idea to quickly eliminate the process almost becomes self-fulfilling.

Frac Diagnostics offers this service to clients.

Liberty, One-Stim Merger

What this Signals for Value-Added Service Providers

Lyle V. Lehman > October 1, 2020

By now most, if not all, of the upstream energy world knows that these two companies made a deal, which can be viewed several ways. On one hand, Liberty will probably become the No. 2 pumping service provider in North America. Another view — Schlumberger (SLB) decided to make a deal before the market drove the company to exiting outright. Those perspectives, however, as well as other viewpoints, are not the topic of this analysis. Instead, I prefer to focus on my belief that the transition of SLB out of the North America pumping market signals that value-added services are circling the drain and heading toward extinction.

As a former member of the executive committee for SLB's leading competitor and current world leader in pumping services, I viewed SLB as primarily a value-added service provider. Its offerings were marketed as 'unique' and in a manner that made the outside-looking-in observer think SLB was inventing everything new. The company, however, was typically second to market technology after other bright minds developed the formal technology.[1] At that point, SLB would give the technology its name and brand and never ever cite the original work in technical circles. 'Our invention is best' was SLB's branding technique. A bit austere, I believe, but SLB has the right to do this, and to me, the company does it well.

Today though, 'value added' means more fees on the ticket. And in the unconventional world, more costs lead to drilling fewer wells. My take — 'Unconventional' has evolved from producing a reservoir not considered a viable target in 2001 to completing a reservoir that generally has very poor properties to allow the profitable recovery of hydrocarbons long enough to pay for drilling and completions. Therefore the need to cut costs becomes the method of completion with a far-reaching impact and need to utilize the supply chain manager to make decisions instead of the highly skilled engineering staff.

I think SLB knew this, saw the end of value-added service demands coming, and — after experiencing issues with investor groups asking why SLB's technologies were not accepted at the forecasted rate as well as the cultural meshing problems it had with the 2017-18 Weatherford acquisition — decided if a buyer could be found, a deal should be made.

In closing... hurrah and long live Liberty, which I believe is better positioned than other providers to succeed in these covid- and unconventionally-driven decision times. To SLB, you fought a good fight. I will miss your branding, your austere attitude and your ability to manage intellectual property.

----------------

References:

[1] An example is the difference between Pinnacle Technologies' Stimulated Reservoir Volume (SRV) and SLB's Enhanced Reservoir Volume (ERV). SRV was almost 14 months ahead of ERV, but when SLB marketed the ERV concept, one would think SLB invented it because the company ignored the previous work. Side note: the framers of SRV from Pinnacle Technologies now reside at Liberty.

Trends in Stimulation — Winter 2019-2020

Lyle V. Lehman > December 7, 2019

Some topics are currently getting attention in stimulation. This article reflects our view as to how they fit your project's economics and asset development.

The Refracturing of Horizontal Wells

'Refracturing'. A worthy topic which has now found its way into the horizontal world. It is speculated that refracturing began in the early 1950's, of course in vertical wells. But the reality is that the first well was fracture treated three times before the process was considered a success.[1] However, this is not the type of refracturing that we are discussing, so let's define refracturing as the process of re-initiating a frac in a well that has produced hydrocarbons for the purpose of economic gain. Thus, the Refrac is a secondary completion step — sort of a 'booster' — to restart the cash flow. I suppose that an analogue of this would be a remodeling of your kitchen, an update or a face lift where the original asset is reconditioned to produce more revenue than its current state. In either case, the lure of Refracing falls under the financial world of 'found' money.

The reasons to Refrac are probably obvious, but they do lend some credibility to understanding the reservoir before such a process should be undertaken to generate additional revenue. It would be a waste of time and revenue if the Refrac results were the same (if not worse) than the original completion.

Getting to Know the Reservoir

Before a Refrac campaign is started, Frac Diagnostics believes it is extremely important to understand the reservoir and how the completion took advantage of the reservoir properties. Let's look at some reservoir performance basics that weigh into the mix. But first, a little 'chalk-talk' is in order.

Y=mX+B

Above is a simplified equation of a line. In our case 'Y' is production, 'm' is the completion effect, 'X' is time and 'B' is the original capabilities of the reservoir. Simply stated, 'B' represents the production capability of the well in a natural uncompleted sense. In today's world of unconventional reservoirs, 'Y' is practically zero — as the completion effect ('m' in our equation) has to be performed to make the asset economical or even produce any volume of resources.[2]

The chart below is an example Production Type Curve.[3]

Notice how depletion has affected the expectation of the asset.

As in several other areas of reservoir asset management, we tend to understand the Refrac process much better than we understand the asset. This tends to make us want to 'jump' into performing a Refrac without taking into account the asset's actual value or remaining potential. However, the risks involved need to be measured as this is a step in the workflow of Portfolio Management.[4]

Thus, the impact of 'B' in our equation is usually the answer as to why completions fail to deliver economic results rather than the completion practices. Said another way, we tend to have an ambitious concept of what the reservoir is capable of doing, and not what it really is.

To evaluate the asset, several diagnostic steps should be performed which answer the following key question:

Will the Refrac generate sufficient cashflow to support the process?

1. What are the total costs, frac, workover equipment, safety, water, etc.?

Along with costs comes the question of regulatory issues, infrastructure components such as relocating water sources, and other elements that may have been released/dismissed after the initial completion.

2. Is the asset already performing at its most optimal rate?

This is a key question because in the Unconventional world, the importance of permeability is sometimes missed. We assume that fracing a reservoir will 'just make it work' for us when in fact nano-Darcy permeability has very little flow capacity into a fracture.

If the asset is actually performing at its optimum, then an in-field drilling project should be considered, as the assumption that the well is draining at an optimal rate, yet not fitting the Operator's economic expectations means that the reservoir needs to be re-acquired by an additional wellbore.

3. Was the first Completion performed/designed properly?

Yet another element of the production puzzle. Obviously in the current state of very long lateral completions, there can be 10-20% of the fractures that are not performing due to a completion practice issue (read: human error or bad design) as the ability to determine if poor performance is due to reservoir quality or completion issue is THE question.

Workflow to Solving these Questions

That being said, we highly recommend that a post-frac audit be performed that examines the stresses and apparent permeability environment of the well. Then this data will be fed to a reservoir simulator and the early production history will be matched, yielding a very useful information set. This information should tell the engineer and Asset Manager the following:

These values will allow the Asset Manager to determine the need to Refrac or not, and potentially how the Refrac should be performed. And arriving at this final point, Frac Diagnostics concludes the 'how' of Refracing is not nearly as important as the 'why'.

Frac Hits — the Issue Moves Onward

As was discussed by Frac Diagnostics in November 2017, Frac Hits: What They are and How to Avoid Them, Frac Hits are still and probably will be part of the completion landscape for the foreseeable future. Today we can now categorize them as two types: 1) Hits due to close proximity to older wells, and 2) Hits due to natural flaws in the reservoir rock. The first type is fairly well understood and almost predictable if proper modeling-and-matching with a reservoir model are performed. The second type is more of a mystery, yet fortunately for us, the ability to avert them is becoming more of a mainstream process.

The permeability source for a vast majority of unconventional reservoirs is not from the matrix, but from the micro-flaws in the rock fabric. To explain this issue further, here's a bit of 'GeoMechanics 101'.

To the left is a diagram of Mohr's circle as it pertains to depletion and refracturing.[5] Invented by Christian Otto Mohr, Mohr's circle is a two-dimensional graphical representation of the transformation law for the Cauchy stress tensor.

Mohr's circle is often used in calculations relating to mechanical engineering for materials' strength, geotechnical engineering for strength of soils, and structural engineering for strength of built structures respectively. It is also used for calculating stresses in many planes by reducing them to vertical and horizontal components. These are called 'principal planes', in which principal stresses are calculated. Mohr's circle can also be used to find the principal planes and the principal stresses in a graphical representation.

After performing a stress analysis on a material body assumed as a continuum, the components of the Cauchy stress tensor at a particular material point are known with respect to a coordinate system. The Mohr circle is then used to determine graphically the stress components acting on a rotated coordinate system, i.e., acting on a differently oriented plane passing through that point.

In the area of GeoMechanics, this diagram represents the difference between maximum and minimum stresses in the reservoir. GeoMechanics experts can create these relationships to understand the amount of net pressure (in terms of %) needed to dilate natural fractures. Here's the short answer as to why this is an issue for frac hits:

Today, experts have developed several means of minimizing this effect. The use of far-field diversion is on the upswing for this reason. The use of these materials was originally thought to improve diversion in the far-field and generate Stimulation Reservoir Volume (SRV) which was initially proposed by Mayerhofer and Cipolla et al. while at Pinnacle.[8]

Junjing 'ZJ' Zhang, Ph.D. and his team at ConocoPhillips have recently performed a series of laboratory and field tests which show that far-field diversion can best be achieved by using a mixture of fine-to-ultra fine particles.[9] These particles must be in the range of 90% 70 to 140 mesh and 10% 200 to 400 mesh. In layman terms, that is 100 mesh sand + silica flour. However, similar results have been found using Polylactic Acid (PLA) in the same mesh distribution.

Local Permian Basin Proppant — Update

As most are aware, the Operators in the Permian Basin comprise to be large consumers of proppant. As we discussed March of 2018 in a Trending View segment, Sourcing Local Sand in West Texas, the utilization of local sand from the Permian area has its positive and negative impacts. The biggest plus is the lower cost due to a much lower transportation fee. The biggest negative in our experience is the very narrow offerings in terms of mesh size. Basically, you can have all the Permian basin proppant that you want as long as it is either 100 or 40/70 mesh. Very little, if any, coarser 30/50 or 20/40 are known to exist. We have also been told that the mines in and near Brady, Texas are producing finer proppants, almost eliminating 12/20 through 20/40 meshes.Getting back to our line equation, the 'm' (completion) effect on the production in this case includes the cost of performing 'm'. When you consider that the values of 'B' are lower in Unconventional versus Conventional reservoirs, then costs become a high element driving the 'Y' solution in the equation. Thus, there is a compelling reason to lower the completion costs since sand is such a large portion of the total completion costs.

Frac Diagnostic's only advice in this subject is to apply the proper form of conductivity in the cases where conductivity will benefit the completion. This may require a white sand from the Northern states, or even a ceramic or resin-coated proppant. The issue, then of course, becomes knowing the reservoir and understanding the portions of the lateral which are capable of performing at a higher rate with higher applications of conductivity.

Stimulation Design from Drilling Data

Last, we are seeing an increase in the adoption of drilling data to improve the completion designs. This has been evolving for 4-7 years with encouraging results. The alternative is to use geometric fracture spacing and rely on the Wall Street metric of 'pounds per foot' of proppant along the lateral length. Yes, Frac Diagnostics has clients who prefer the geometric approach but more of our clients are accepting the integration of drilling data into the completion design. As a consulting firm that has 'publicly' stated that we prefer science-conscious clients, this is viewed as an acceptance of our business philosophy.The workflow is to incorporate drilling data, often from a database recording every six inches along the lateral, and determine where the sweet spots are located. We prefer to merge into the mix the gas chromatograph data as well to help understand the apparent stress trends.

A word of caution, there are currently two methods for using the drilling data. In the more popular method, the output is Mechanical Specific Energy (MSE) which is more of a brittleness indicator over stress. It is true, high brittleness is related to high stress and vice versa, but not in a linear fashion. When you couple this with the fact that a change in the bottom hole drilling assembly has an impact on MSE, then a lot of human intervention is required to correct the issues. Whereas the minority method takes all of that into account and actually generates an artificial log based on statistical analysis and artificial intelligence which is updated with each project. We support the latter over the former method.

----------------

References:

[1] Source: KGS Publications article link

[2] Much to the chagrin of current anti-fracing political types, if fracing were banned these resources would not be economically productive (another time, another topic).

[3] Source: Federal Reserve article link

[4] One item not discussed here is when a Refrac should be done and at what point in the life of the project. That is a very complex issue and worthy of another time.

[5] Source: Hydraulic Fracturing Journal, 'What Microseismicity Tells Us About Re-fracturing; An Engineering Approach to Re-fracturing Design'

Vol.3, pg 15; Journal article link

[6] Side note: As reservoirs deplete, they become more isotropic. This is due to the fact that the main horizontal stress direction is also the highest permeability direction. Thus, combining the Poroelastic equation with stress direction, one can understand that depletion allows an un-symmetrical drainage pattern resulting in the maximum stress value to reduce faster than the minimum stress, then finally approaching equal stresses.

[7] Remember Newton's law that 'everything in nature tends to go toward its lowest energy state'.

[8] Source: 'What is Stimulated Reservoir Volume?' SPE 119890, 2010.

[9] Source: 'Mitigating Production Degradation by Frac Hits Design and Field Trials of Far Field Diverters', ZJ Zhang, Ph.D., Distinguished Lecturer, 2020-2021.

[Condensed version of original article that appeared in the July, 2019 issue of Hart's E&P magazine]

Biodegradable Diverters Offer Path to Higher Returns

Lyle V. Lehman > August 1, 2019

The celebrated marriage of horizontal drilling and hydraulic fracing has hit a tough patch. To point: We are now producing reservoirs with permeability values as much as two orders of magnitude lower than those developed prior to 2017. These "sub-unconventional" pay zones, if you will, have crossed an abstruse technical and economic threshold, just as investor demands to increase production and cut completion costs raise the collective blood pressure of the entire sector.

Unlike their predecessors, today's ultra-tight reservoirs respond mostly to contact frequency, rather than conductivity. As such, operators focus on extending the effective frac stage length and/or enhancing oil and gas flow within each stage, all the while reducing cycle time on location. Here, flow uniformity to increase the drainage of every stage must be the central component of any frac design. That said, what we've found in our practice is that designing a frac program around the use of largely unsung biodegradable frac diverters is unequivocally the single most effective way to deliver the higher returns investors demand. In fact, I know of no other tool that singularly delivers higher reservoir productivity, while lowering completion costs and risks.

Simply put, frac diverters plug perforations and near-wellbore heel clusters, which greedily consume more than their share of frac fluid, and re-direct flow to mid-interval and outer-toe fractures that inherently receive an inordinately lower volume of the proppant delivery medium. By increasing the effective stage length, reducing spacing between the individual clusters, and generating uniform flow you increase both production and estimated ultimate recoveries (EUR), while simultaneously reducing the completions cycle time and associated costs, which I'll touch on in a moment. But first, a bit of perspective is in order.

During the shale explosion of 2004-2009, we had cracked the code and began producing full bore from what had been rightly described as "yesterday's dry holes," meaning zones once deemed too impermeable to be regarded as anything other than sub-par assets. While those reservoirs relied on high degrees of conductivity and infrequent contact to maximize production, their contemporaries feature the shallow migration of hydrocarbons into ultra-impermeable rocks that are best defined as "contact type" reservoirs.

Whereas the "conductivity-type" rocks of yesteryear generally required costly ceramic and other high-yield proppant, the new-age emphasis on contact and frequency means a low to moderately conductive, and less expensive, sand proppant sufficiently generates economic production and higher EUR. At the same time, when you can extend the effective stage length, you not only reduce the number of friction-inducing cycles that notoriously stress couplings and can eventually deteriorate into parted casing, but also require fewer plugs. In the Delaware Basin for instance, the price tag for plugs alone range from $3,900 to $6,900/set.

By far, however, reducing the completions time represents the single most influential cost saving component. Back to the Delaware Basin, we find that using a fixed-cost pricing model of a mid-sized service company, where time on location and materials are priced separately, a 12-hour reduction in time would equally result in a roughly 12% spread cost reduction. Also keep in mind that as the name implies, biodegradable diverters degrade into benign and water soluble lactic acid, which simplifies removal during the wellbore clean-up process.

All-in-all, from our experience the less time on location and the lower associated material costs have resulted in documented cost savings of up to 28%. More importantly, field recaps have shown across-the-lateral flow uniformity generally boosting production rates anywhere from 18% to 40%, while we've also seen EUR values 12% to 40% higher.

At the end of the day, a case undeniably can be made that from a mathematical perspective, biodegradable diverters are the only tools available that can both lower the denominator (costs) and increase the numerator (production yield) in the value-return on investment equation of unconventional wells.

For more details on how I arrived at this conclusion, I encourage you to check out "Unsung tools for boosting profitability of unconventional wells" by Lyle V. Lehman, et al, in the July 2019 issue of Hart's E&P magazine.

[Condensed version of original article that appeared in the November, 2018 issue of World Oil]

Too close or just right?

Lyle V. Lehman > November 15, 2018

While attending a DUG conference several years ago, I heard someone say during a Q&A session that the best way to get 10 good wells from an unconventional play is to complete 100 wells. To me, that remark smacked of poor planning and settling for a "whatever-comes-your-way" rationale. Unfortunately, that thinking can still be found in the unconventional community, particularly when it comes to determining optimal fracture spacing.

The near-universal strategy for today's unconventional completions is to load up more and more proppant per lateral foot and narrow the fracture spacing to increase pay zone contact frequency. The idea is that shortening the space between fractures compensates for lower-than-expected source rock permeability, thereby heading off the rapid drop in production that comes when reservoir fluids struggle to flow through the rock fabric.

All this is well and good, but what exactly constitutes optimal fracture spacing? Frankly, the only way to answer that question with any semblance of precision is to take the time and energy to develop a thorough understanding of the characteristics of your specific reservoirs, together with looking at the reservoir-specific economic considerations that will promote higher production and, with it, higher returns on investment. For this approach to be effective, you must first get a firm handle on the permeability distribution of the targeted pay zones and design your frac program accordingly.

In our practice, we have demonstrated that taking an engineered approach to designing the fracture-spacing scheme can pay tremendous dividends, including considerable increases in reservoir drainage. As a case-in-point, our experience in modeling Wolfcamp wells in the Delaware Basin has resulted in fracture spacing progressively shrinking from 120 ft to 40 ft, with the prospect of 25-ft fracture spacing lurking around the corner. While steadily narrowing the fracture spacing, our engineered approach has helped deliver a roughly 24% increase in initial production rates, with an estimated 8% improvement in estimated ultimate recoveries (EUR), as well as 90-, 120- and 180-day net gains in barrels of oil equivalent (boe) recovered.

Without digging too deeply into the weeds here, our methodology is built around the mostly overlooked art of using frac data for net pressure-matching fracture stimulations and the building of a mechanical earth model that distinctly represents your specific reservoir. We have also found that the construction of a correlation database of near-wellbore and stage-centric data is an extremely useful tool.

Once the database is assembled and the predictive model refined, the data is then transferred into the reservoir model that includes every critical element, such as stress, permeability, reservoir pressures and the like, extending to those with less relevance that, nonetheless, could impact your reservoir, and ultimately, economic performance.

Through this exercise, you may discover three or more factors that drive your project's economics. Let's say, for example, that the model shows reservoir permeability, completion contact percentage, frac fluid volume and proppant conductivity are the predominate technical enablers for high reservoir performance. In this scenario, your best bet is to shell out for premium, high-conductivity proppant. On the other hand, if the analysis indicates reservoir permeability on a new well is actually 50% of the original value, the model would advise that contact must be increased 70% with a reduction in proppant conductivity. In that case, you only need a lower-quality and less expensive proppant that simply scours and potentially bridges the fractures. And as we all know, in today's unconventional economic environment, the marching orders from the investment community can truly be summed up in "get more and spend less."

At the end of the day, accepting the results of a new and fully calibrated model can only come with time and really needs a champion to realize that the answers make sense, the model is good (or bad) and, when all is said and done, fracture spacing is being optimized.

To learn a bit more on Frac Diagnostics' methodology for optimizing fracture spacing, check out the full article "Can 'too close' be ill-advised in fracture spacing?" published in the November, 2018 issue of worldoil.com. (Subscribing to the publication may be required in order to view.)

Click the arrow below to listen to the Deep Dive Podcast featuring Lyle Lehman discussing the article in more depth.

Ode to a Great Client

A Case Study in Managing Client Expectations and Goals

Lyle V. Lehman > September 16, 2018

One of my best and favorite clients recently accepted an offer to sell their properties in the Delaware basin. Of course, in today's market, these decisions occur on a weekly basis. In this case, while happy they get to reap the fruits of years of labor and sacrifice, I'm also saddened because I'll miss the interaction, until if or when they decide to re-group and start over.

In consulting circles, handling a client's goals while tempering them with the realities of their particular situations, is known as 'client management'. As a consultant, I specialize in client management and the more experienced I get (note grey hair) the easier it becomes. However, developing this management skill certainly was anything but easy in the beginning.

Take this client for example. They were developing a portfolio of properties in the Bone Springs - Wolfcamp, several of the shallower Canyon reservoirs, along with some other reservoirs they were considering. They basically were flying under the radar, yet managed to be fairly successful in picking up prospective properties. At first, I was helping them establish better practices for completing these formations and afterwards helping improve these practices for better well results. Keep in mind that when we began this work in 2012, some of the targeted reservoirs clearly represented the most extreme definition of 'unconventional'. In other words, at that time you would not regard these reservoirs as viable, but that's the space in which we were playing.

Working together, we bridged several milestones over the years:

We developed the case against 100-mesh sand. We discovered 40/70 proppant was just as capable of providing bridging and diverting than 100-mesh. The service companies definitely applauded the switch as they were concerned about the erosional issues 100- mesh sand would have on their equipment.

We established the best method of perforating, and it was not limited entry. The actual perforating scheme we developed was a basic 8 shots per cluster. Why not limited entry? Simply put, perforation geometry, as discussed in SPE paper 18273, eliminates the benefits of limited entry. If a perforation cannot open, simply relying on excessive pressure to open the perf job is a false expectation. While the paper did not express this fact in this manner, that's the bottom line.

We developed cluster spacing theory, then tossed that out and redeveloped a better theory. One of the best criteria for a satisfying client relationship is when they join you in refusing to remain fixed to the 'status quo', and actually try to generate some innovation to meet their goals. We did this with cluster spacing. 'Back in the day' we were limiting ourselves to 3 clusters per stage, but as we drew the cluster spacing tighter, we quickly figured out that adding stages to cover the gross lateral distance would require more time, and as we all know, more time on location not only equals more costs, but more risks of events like parting casing. So, we quickly went to 4 clusters per stage and, owing to analysis of the treating data, learned this was basically effective. Yes, we had some cases where the perforation loss was equal to a cluster (and in some cases 2 clusters, meaning that of the 32 holes perforated, we could only measure 16 open perfs), but the overall impact was negligible.

We employed drilling data into the cluster placement and benefited by improving perforation efficiency. This was a very efficient step forward and, sad to say, we employed it on the most recent — and now last — well in their now-sold portfolio. The huge difference is that we went from 45 to 61% perforation efficiency to more than 90% by simply allowing a third-party consulting company to use the drilling data to generate a stress along the lateral (there are 2 providers of this data and it is captured on 6-in. intervals). This enabled us to see the benefit of moving a cluster 5 to 10 ft or so to level-off the stress between the clusters and allow more clusters to open on the initial breakdown. Production results are better and the cost for remediating this issue was recovered within hours.

These, and other milestones, exemplify the mutual benefits of a close client-consultant collaboration. But, getting back to my personal feelings of missing the interaction and working relationship with this client, I'm reminded of what guitarist Bernie Leadon said 6 months after he left the Eagles rock band. He justified leaving the widely popular group he helped found by saying he was tired of the touring and never liked the pressure of big money-making bands. He'd simply wanted to make music and be happy. Sometime after his exit, Bernie attended an Eagles concert where he first saw his replacement, Joe Walsh. While happy for Joe, Bernie said upon watching the on-stage repartee he was once a part of, he came to realize that being enmeshed in an expert team actually meant more to him than he'd realized.

For sure, being a part of the synergy that accomplishes goals is addicting, exhilarating, and requires constant practice. That, my friends, is precisely why we consult.

Sourcing Local Sand in West Texas

Is this a Good or Bad Thing?

Lyle V. Lehman > March 16, 2018

Listening to several of my Delaware Basin clients speak the other day about the news of several sand mines opening brought mixed feelings. I fear the good news may not be as affordable as everyone hopes. From an article in the industries periodical Aggregates Manager, published in January of this year[1], by the end of 2018 there could be the capacity to produce 14.3 to 20 million tons of frac sand per year from these mines... and that's only the beginning. That volume represents up to 50% of the total Permian Basin proppant market this year alone and with the announcement of additional plants coming on board, it is easily feasible to predict that the entire Permian market will be locally sourced. Plus, some proppants will be available for other markets which suffer from travel expense of Northern White Sand.

Good News. Obviously, the best news is that the transportation costs alone will be reduced 40%. Because hydraulic fracturing has become a leading portion of the AFE for well costs[2] (and that is absolutely nothing to take lightly). This will have a major impact[3] on reducing well costs. Total well costs will go down. For this reason, one of my clients — who clearly subscribes to the 'conduct v. conductivity theory of completion' — fears that his company will be forced to use the inferior sands solely due to cost reduction. This cost reduction alone could mean that a package of 7 or 8 wells, with reduced cost due to proppants, may yield enough funds to drill an additional well. That is a very strong argument for using these sands.

Bad News. Simply stated, this is poorer product replacement. Current reports are that most of the sand in the Monahans-Kermit area will produce 60 to 70% 100 Mesh and smaller than 100 Mesh-category of proppants. The remaining will be mostly API 40/70 mesh with very little coarse sand. In Frac Diagnostic's practice, and if you have dug through our website you will know this, we view some source-rock reservoirs[4] as being better completed using conductivity and the other reservoirs benefiting principally from frequent contact. In the contact types, what we mean are performing fracs on a very frequent basis, something like every 20-60 ft. of measured depth along the wellbore. These reservoirs will benefit in the mid-term (we seldom see any long-term production when it comes to sub-microdarcy rock) from frequent contact and the 40/70 sand. Logically, the reservoirs that respond to conductivity placement will not benefit from fine-grained proppants.

What Does this Mean? Let's get a few dialogue points into the equation:

y = mx + b

This general equation represents the value of an outcome (y) which is based on the original value (b) and the impact of a modification (m) with time (x). I don't know the origin of this relationship, but while attending college back in Norman, this was offered to me as a grand solution to understanding many principals, so I have used it to illustrate many concepts. Here, the concept is that the completion impact (m) does not totally control the cumulative production (y) as the original reservoir capacity (b) must be part of the effect.

Getting back to... What Does this Mean? I recall a probable analogue: a situation when encapsulated breakers were introduced into the stimulation chemical portfolios. It was during this time that better well responses were occurring, given the reservoir temperature, when encapsulated breakers were used in the frac treatments. That benefit was obvious to many and when the next wave of 'searching for a gold mine in a waste pit' came around, knowing that a well was drilled and completed before ~1985 (when encapsulated breakers were introduced) was one indicator we used while shopping re-frac candidates.

Current Analogue. Ceramic and resin-coated sands represent quality conductivity. However, in late 2016, their use reduced around 80-90% in the US. This was principally due to the cost of the products and the reduction in oil prices. But as more and more Operators substituted the use of quality conductivity products by switching to lower quality sands, they began to experience the penalty of using lower quality sands was not as detrimental as expected. In other words, placement of quality conductivity was not as beneficial to their bottom line[5], being the 'm' in our equation. This issue continues today and, outside of the possibility of proppant grade sand not being available, the future of quality conductivity is potentially a boutique — applicable only in the more stress-hostile environments such as deep reservoirs and international plays.

Other Proppant Sources. Of course, Heart of Texas sands are located in and around Brady, Texas which is 268 miles from Kermit. However, their supplies are fairly thin and they are not known to survive in the mid-to-moderate stress environment as referenced by the Wolfcamp and other similar reservoirs of the Delaware Basin. The Northern White Sands are preferred, but as we have been saying, due to transportation, they come at a cost.

The Bottom Line... Cost Drives nearly Everything. My point here is that although the completion experts of the oil companies may acknowledge that they should be using Northern white sands, or resin-coated sands or even ceramic proppants, they will succumb to the low cost of the potentially inferior Kermit-Monahans sands and just be happy to drill and frac with less expense no matter which reservoir type they develop, both the contact or the conductivity types.

My Forecast. I strongly feel that after the 'new sand source' era is over, we will probably lead to a return of Northern White Sands in deeper circumstances, like the deeper Wolfcamp shales. But that will be in 2020, when we hopefully have a better view of our choices.

----------------

References:

[1] Source Publication: Aggregates Manager; 3 Frac Sand Mines Open in West Texas, 23 More in the Works:

aggman.com article link

[2] This is due to horizontal drilling allowing a wellbore to be placed in the pay zone for 0000's of feet, which makes it possible to place 12,000,000 lb. or more of proppant in a single well, thus increasing the completion costs.

[3] Source Publication: Aggregates Manager; Construction of Frac Sand Mines in Texas Threatens Livelihood of Wisconsin Mines:

aggman.com article link

[4] This is what used to be known as 'Unconventional Reservoirs'. But seriously folks, when a reservoir requires fracing to be economical to produce, that is unconventional. The real paradigm shift occurred when the industry decided to complete wells in the hydrocarbon source, rather than the hydrocarbon target formations.

[5] An oddity in the use of finer materials such as 40/70 sand is that the higher number of particles tends to relieve the stress distribution in the proppant pack. Meaning that coarser sands crush at a lower stress than finer sands.

How the Hunt for Great Cabernet

Revealed an Energy Policy Change Enacted by Fear

Lyle V. Lehman > October 1, 2017

A short time ago, my wife Brenda and I were chasing one of our passions of visiting all of the great wine producing regions of the world as we are collectors and have put some serious money and study into it. This vacation we chose Margaret River Western Australia (WA) as Brenda is a Cabernet fan, and they certainly produce great wines there. QANTAS offers many wines from Margaret River on their flights, and since I know QANTAS' wine director, that was all the reference that I needed.

After learning to drive from the right side of the car on the left side of the road, we managed to visit the little town of Margaret River and were in a very nice store examining local olive oils and the like. The store owner heard us speak and knew that we were 'not from around there" so she engaged us in talk. Soon the question of 'What do you do?' came up, and after I told her that I am a fracturing specialist, she advised me that she was okay with it, but that a very vocal minority of locals had helped to support a moratorium on fracing in Western Australia. Of course, I was not aware of any active oilfield work south of Perth — I have performed some analysis of stimulation data from wells north of Perth, therefore had some direct knowledge of WA — so I assured her that she had little to worry about. Then the story got more interesting.

A few days later, Brenda caught a glimpse of this sign (image right) at a very popular pub near Dunsborough, WA.

(My second warning, notice the 'k' in fracing. It's a clear signal that the people who created the poster are amongst those who don't know what fracing is to spell it correctly.)

The next morning on 20 September 2017, the Prime Minister, the Honorable Malcolm Turnbull, held a press conference in Brisbane announcing that he was taking actions to keep gas from leaving Eastern Australia as a gas shortfall was occurring, raising prices which further raises the price of electricity which effects all consumers — and being a Labor Party member — Turnbull cited the struggle that the high cost of electricity has on retired people and the poor (notice: class envy works 'down under' too). Turnbull further mentioned that he was pursuing active investments in renewables and the like, being the Labor Leader that he is.

But I started wondering what this was all about. I knew that Australia had plans to become the #1 gas exporter, so I assumed that they would employ whatever technology was needed to fill their liquid natural gas (NGL) plants and meet their contracts. They have employed fracing in the Cooper Basin of Queensland and South Australia, and that basin in particular is world-renowned as being a very difficult one to complete wells economically, and only through fracing can it be done.

About that time, I received a call from a business acquaintance who is trying to promote a non-liquid based fracing alternative. He told me that his potential client advised him to seek business in Australia because most of the country had placed a mortarium on fracing. Purely by coincidence and Brenda's love of Cabernet, I found myself on one of the political battle lines involving fracing.

How did this happen?

If you are having trouble keeping up, the score so far is that the main three Australian energy providers — Origin, Santos and Shell — along with a lot of other small coal bed methane operators (they call it Coal Seam Methane for reasons that I don't understand) had pledged gas to fill the new NGL plants so they can make Australia the #1 gas exporter. This means jobs, stronger economy and more ability to attract good people to the land of Vegemite and Kangaroos. But somehow, these goals cannot be met while also having enough gas to generate cheap electricity for the citizens of Australia. My interpretation is that the profits from contracts to provide higher-priced gas for export outweighed the cheap domestic gas and there is a supply shortage in an area that is rich in supplies, or so it seems. How did this happen? What was the first step in this process of failure?

Simply stated, an American — Josh Fox and his movies: Gasland I and Gasland II.

Gasland I premiered in 2010 and in a short time was the talk of the town. Over time, most if not all of Josh Fox's allegations have been proven false and I won't go into that fight as many have corrected him. Speaking of QANTAS, the airline showed Mr. Fox's films on their domestic flights all over Australia which, if you never watched the Manchurian Candidate, you need to know that if exposed to any bit of information often enough, many people will begin to believe it. Despite claims that are proven false and in some cases, defy the laws of physics and time for that matter, many people, including the wine growing citizens of beautiful Margaret River, believe Fox.

Thinking that money drives everything, I wondered what motivated Mr. Fox to tell lies and promote his films. Good guessing on my part. If you look into the financial backing of the Gasland movies and then the $$ offered to allow QANTAS to promote the movie on their flights, you eventually come to at least one unique source: the Soros family.

Let's follow the money to find out. Fox reportedly received $750,000 from HBO Documentary Films to pursue Gasland Part II. No one can verify how much money changed hands or who exactly it went to however. This is because Fox's non-profit production company, Sweet Jane Productions, Inc., has yet to file an IRS Form 990 for any period since June 30, 2010. He uses this non-profit corporation as a vehicle to collect government grants and support from the likes of the Rockefeller Foundation ($50,000 for an "interactive drama exploring theater as immersive and educational"). He has received at least $275,000 from Park Foundation for promoting his anti-gas films and a proposed Gasland Part III. Whether his charity facade was used to collect HBO money for Gasland Part II is unclear.

What is clear is that the President of HBO Documentary Films, Sheila Nevins, has been closely involved with the Soros family through another non-profit corporation called the Creative Capital Foundation, which has been another source of funding for International WOW, Fox's d/b/a for Sweet Jane Productions. International WOW received $50,788 from Creative Capital in the last fiscal year for infrastructure support and Sheila Nevins was an early board member of that organization, along with Jeff Soros, the film producer-nephew of George Soros, the insider trader and funder of so many leftist causes and other nefarious enterprises (e.g., almost bringing about the economic collapse of the United Kingdom).

The nephew Soros has a film company and apparently has put out one film after more than a decade. It's apparently quite good but, fittingly, is called 'A Small Act' and, of course, was put out by HBO Documentary Films. Prior to that film in 2010 he appears to have spent most of his time writing screenplays that didn't get produced and learning how to give his money away. Meanwhile, his uncle George and cousin Jonathan have been giving Andrew Cuomo $750,000 to play Hamlet on the Hudson, Lady Macbeth and any number of other tragic Shakespearean characters that come to mind as he puts upstate New York through a living hell. No doubt George likes the idea of keeping New York out of the fracing game — it probably increases the value of his Petrobras investment. Although Soros is the kind of guy who plays both sides in order to win.

The US anti-frac efforts miss their target

In 2009, Barack Obama took office as President of the United States. With this event, the oil and gas industry felt a shift in energy policy, which might be best characterized by former EPA Administrator Al Armendariz's 'crucify them' comment about the industry in 2010. In October 2009, the US House of Representatives took steps towards initiating the EPA Hydraulic Fracturing Study. This latter effort was described as a 'peep show' by the late Dr. Michael Economides in May 2011 and was viewed as one of several attacks on the industry. During Obama's first term, US Senators Henry Waxman and Ed Markey and US Representative Diana Degette also led several inquiries into hydraulic fracturing. The January 2010 release of the movie Gasland I and the April 2010 blowout in BP's Macando well may have fanned the flames fueling anti-industry sentiment during this time.

From a historical perspective, the EPA Hydraulic Fracturing Study seemed to be the aftermath of disputes starting in the 1990's regarding regulation of producing wells drilled in coalbed methane (CBM) reservoirs. In Alabama, environmentalists noted how some CBM wells are fraced near or within geologic formations classified as Underground Sources of Drinking Water (USDW). With this, environmentalists felt that the CBM wells should be treated as Class II injection wells regulated under the EPA Underground Injection Control (UIC) Program. In 1997, the Eleventh Circuit Court of Appeals sided with argument of environmentalists, which sets the stage for later events. First and foremost, the State of Alabama revised its UIC program to regulate the fracturing of coalbeds. In June 2004, the EPA published a study of fracturing CBM wells in the United States. In 2005, the study's conclusion that fracturing in CBM "poses little or no threat to USDWs" would be used to justify legislation involving fracturing. During this time, environmentalists criticized the CBM study based on potential conflicts of interest. Critics also touted a 2003 memorandum of agreement eliminating the use of diesel in CBM fracturing as proof that there was a problem. In the years leading up to the release of Gasland, much of this sentiment appeared to be unresolved.

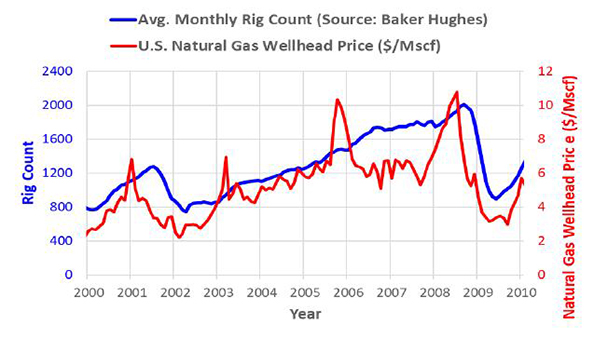

Figure 1: 2000-2010 United States Rig Count (Source: Baker-Hughes) and US Natural Gas Wellhead Price (Source: EIA)

From the start of 2002 to the end of 2008, the industry experienced a steady increase in activity (Figure 1). Much of this pace was driven by commodity prices. During this timeframe, oil and gas operators began finding success exploring deep, unconventional reservoirs (shales). Operators also gained efficiencies from using horizontal drilling and following up with completion technologies such as hydraulic fracturing. Even though unconventional reservoirs are typically separated from USDWs by thousands of feet of rock, the level of activity surely caught the attention of environmentalists and other industry critics. Furthermore, certain entities across the globe most likely viewed hydraulic fracturing as a threat since its application in the US increased the supply of oil and gas, and therefore impacted commodity prices.

And the latest news came on September 29 that Russia could possibly be behind anti-fracing propaganda on Facebook and Twitter... (calling the Manchurian Candidate).

Where do we go from here?

All and all, one needs to understand a basic fact that drives America's acceptance of fracing as a completion tool: Most Mineral rights in America are owned by individuals, not the government. To illustrate my point, if you take the time to watch Frackman the Movie, the opening remarks convey that Dave Pratzky of Queensland Australia (the subject of the movie) says that he was not in control, nor could he benefit from the coal seam gas production under his land, whereas most of the land owners in the Eagle Ford and the Permian basins do benefit. Pratsky's motivation to stop the process is clear, and I for one cannot fault him for that. No one wants to watch people freely coming and going on their land and disturbing their environment.

As I have said, it all gets back to money and I feel that as long as we frac folks continue to take the precautions to make the practice as safe as we can and are cognoscente that people such as Dave Pratzky and Josh Fox are making money off our potential carelessness, real or imagined, that everything will be OK — at least on my watch.

----------------

Acknowledgements:

Brian Dzubin of Frac Diagnostics, LLC contributed much of the background content in this piece.

----------------

References:

The Australian PM, Past and Present Blame Game:

theguardian.com/australia-news

Assuring Cheap Gas for Australia:

www.pm.gov.au/media

Josh Fox Exposed, Part 1 (of many, but a great moment in Journalism, live!):

An honest crusader against exploitation of his land:

youtube.com

Gasland Part II Funding, follow the Soros Money:

naturalgasnow.org

An honest crusader against exploitation of his land:

frackmanthemovie.com

Coalbed or Seam, you pick:

ga.gov.au

Russia buys anti-frac ads for Facebook and Twitter:

reuters.com